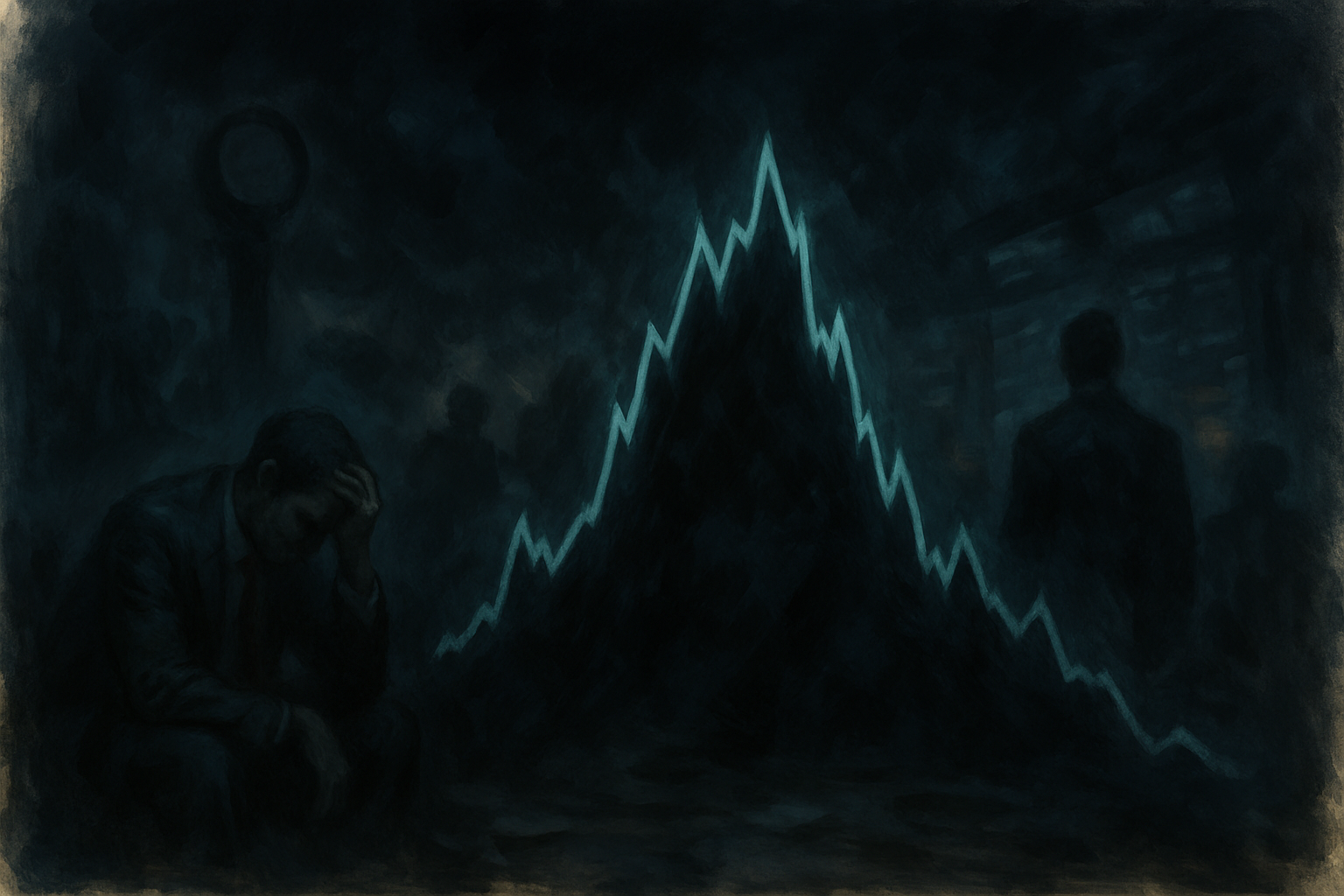

Bubbles and Crashes

The History of Financial Bubbles & Crashes

Markets change, but human behavior does not. For centuries, investors have cycled through optimism, euphoria, and panic — creating bubbles that eventually collapse under their own weight. Understanding this history helps you recognize today’s warning signs long before the crowd sees them.

While the assets may differ — tulips, railroads, internet startups, or housing — the underlying pattern remains the same. Easy money fuels speculation, valuations disconnect from reality, and eventually the bubble pops. What follows ranges from painful corrections to full-blown financial crises that reshape economies.

Major Bubbles and Crashes on the Timeline

1. Tulip Mania

Often considered the earliest known speculative bubble, Tulip Mania saw rare tulip bulbs reach prices far beyond rational value before collapsing nearly overnight.

2. The South Sea Bubble

The South Sea Company made promises of enormous trading riches. Speculation surged — and collapsed catastrophically when reality surfaced.

3. Railway Mania

Investors poured speculative money into railways, many of which never produced profits. When financing dried up, the collapse was severe.

4. The 1929 Stock Market Crash

A decade of speculation fueled by easy credit ended in one of the largest market collapses in history, triggering the Great Depression.

5. The Japanese Asset Bubble

Extreme real estate and stock valuations imploded, leading to decades of economic stagnation.

6. The Dot-Com Bubble

Thousands of internet-driven companies soared — and then crashed — when earnings failed to support sky-high valuations.

7. The Housing & Credit Bubble

Excess leverage, mortgage derivatives, and lax lending standards fueled a global crisis when housing prices faltered.

8. The “Everything Bubble”

Low rates and historic liquidity pushed nearly every asset class to extremes. Many believe we are now living through its unwinding.

The Timeless Pattern Behind Every Bubble

- Displacement — A new idea or environment emerges.

- Boom — Prices rise and excitement builds.

- Euphoria — Valuations detach from reality.

- Stress — Cracks appear, liquidity tightens.

- Crisis — Prices collapse as confidence evaporates.

- Revulsion — Investors swear off the asset.

- Recovery — Markets rebuild from rational levels.

History shows that bubbles and crashes are not random. They follow a predictable psychological arc that repeats across centuries. Recognizing the patterns early gives investors an advantage — especially in today’s stretched, fragile environment.

Understanding bubbles is not about predicting exact tops. It's about protecting capital before excess reverses, then using the reset to your advantage.